MOIC (Multiple on Invested Capital) vs. IRR: Key Differences

In private equity, venture capital, and other investment vehicles, understanding the performance metrics is crucial for investors to assess the effectiveness of their investments. Two of the most widely used metrics are MOIC (Multiple on Invested Capital) and IRR (Internal Rate of Return). Both metrics offer valuable insights into the profitability of an investment, but they differ in how they measure performance, and each serves a distinct purpose.

In this article, we’ll break down the key differences between MOIC and IRR, explain how each is calculated, and highlight when each metric should be used to evaluate an investment.

- Definition

MOIC (Multiple on Invested Capital): MOIC is a simple metric that measures the total value generated by an investment relative to the capital invested. It is calculated by dividing the total value realized from an investment (including both distributions and the current value of unrealized investments) by the total capital invested.

The formula for MOIC is:

MOIC= Total Capital Invested / Total Value of Investment

MOIC tells investors how many times their initial capital has been returned. For example, a MOIC of 2x means that the investor has received two times the capital initially invested.

IRR (Internal Rate of Return): IRR is a more complex metric that calculates the annualized rate of return on an investment, taking into account the timing of cash flows. IRR represents the discount rate at which the net present value (NPV) of the investment’s cash inflows equals the NPV of its cash outflows (the capital invested).

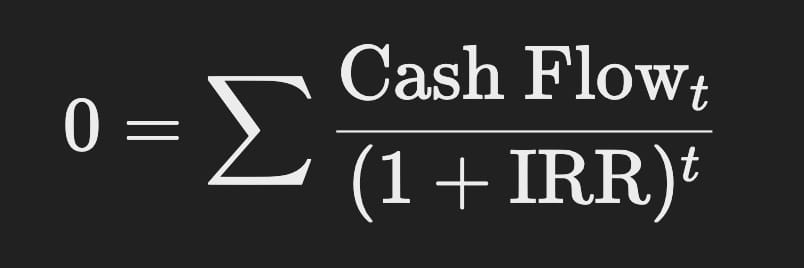

The formula for IRR is more complicated and typically requires financial software or a calculator to compute, as it involves finding the rate that makes the following equation true:

Where t represents each time period during the investment, and Cash Flowt refers to the cash inflow or outflow at each time period.

IRR reflects the time value of money, and it is useful for understanding the efficiency of an investment over time.

- Key Differences

Focus: Timing vs. Magnitude

- MOIC focuses on the total magnitude of value generated relative to the capital invested, without considering the timing of cash flows. It’s a straightforward way to see how much value an investment has created, but it doesn’t take into account the time at which returns were realized.

- IRR, on the other hand, accounts for the timing of cash flows. It gives an annualized return that reflects how quickly or slowly the investment has generated value. This makes IRR a more dynamic measure of profitability, as it captures the impact of the timing of inflows and outflows, such as early distributions versus later distributions.

Time Factor

- MOIC does not factor in the time horizon of the investment. For example, an investment that returns 3x after 10 years has the same MOIC as an investment that returns 3x after 2 years, even though the latter is likely to have generated value much faster.

- IRR incorporates the time value of money, meaning it reflects how long it took to realize returns. A higher IRR suggests that the returns were generated quickly, while a lower IRR indicates that the investment took longer to yield returns. This makes IRR particularly useful when comparing investments of different lengths.

Complexity

- MOIC is relatively simple to calculate. It’s a ratio that compares the total capital invested to the total value generated by the investment, making it a straightforward metric for investors to use in evaluating performance.

- IRR is more complex and requires knowledge of the timing and amount of cash flows to calculate. It involves solving for a rate that balances the present value of cash inflows and outflows, and it typically requires a financial calculator or software to determine.

- Applications: When to Use MOIC and IRR

MOIC: Best Used for Simple Comparisons

- Ideal for Long-Term, Illiquid Investments: MOIC is often used when comparing investments in funds that have long time horizons or in illiquid investments where cash flows are uneven. For instance, a private equity firm or venture capital fund might use MOIC to track the overall value generated from an investment without needing to account for the timing of the distributions.

- Simple Performance Metric: MOIC is a useful metric when you want to see how much value has been created over the course of the investment period. It gives you an easy, high-level view of how many times your money has been returned.

- Comparing Investment Magnitude: If the primary concern is understanding the total amount of value created by an investment rather than when it was created, MOIC provides a quick snapshot.

IRR: Best Used for Efficiency and Timing Analysis

- Ideal for Comparing Investments with Different Time Horizons: Because IRR accounts for the timing of cash flows, it is particularly useful when comparing investments with different durations or those that have uneven cash flows. For example, an investment that pays a significant portion of returns early on will have a higher IRR than one that pays returns later, even if both investments have the same final value.

- Evaluating Investment Efficiency: IRR is ideal when you want to assess how efficiently an investment has generated returns over time. It provides an annualized return figure, helping investors understand the compounded growth of their capital.

- Assessing Cash Flow Timing: If you are evaluating a deal with multiple cash inflows and outflows over time, IRR is better suited for understanding the timing impact on the returns.

- Examples to Illustrate the Difference

Example 1: Two Investments with the Same MOIC

Let’s assume you invest $1 million in two separate ventures. In one scenario, the investment generates $3 million in total value over 10 years, and in the other, it generates $3 million over 2 years.

- MOIC:

Both investments would have the same MOIC of 3x ($3 million total value / $1 million invested). However, the investment in the second scenario (2 years) clearly produces a return much faster. - IRR:

The IRR of the second investment (2 years) would be much higher than the first one (10 years) because the returns were realized over a shorter period.

Example 2: Different Time Frames, Same Investment

Suppose you invest $1 million in a company, and after 5 years, the company returns $2.5 million.

- MOIC:

The MOIC for this investment would be 2.5x ($2.5 million / $1 million invested), which tells you that the company has generated 2.5 times the value of your initial investment. - IRR:

The IRR calculation would consider the fact that the returns were realized over 5 years and provide an annualized return figure. If the investment took 10 years to generate the same $2.5 million, the IRR would be lower.

- Limitations of MOIC and IRR

- MOIC Limitations:

MOIC doesn’t account for the timing of returns, which can be critical in evaluating the efficiency of an investment. It also doesn’t reflect the risk-adjusted return, meaning two investments with the same MOIC could involve very different levels of risk. - IRR Limitations:

IRR can be misleading in some situations, especially when cash flows are irregular. For example, if an investment has a large negative cash flow early on followed by positive returns, IRR may overestimate the investment's true potential by placing too much weight on later cash flows. Additionally, IRR assumes reinvestment of interim cash flows at the same rate, which may not always be realistic.

Conclusion

Both MOIC and IRR are important metrics for evaluating the performance of private equity, venture capital, and other types of investments. MOIC offers a clear and simple snapshot of how much value has been generated relative to the capital invested, making it useful for long-term and illiquid investments. IRR, on the other hand, provides a more nuanced understanding of investment performance by factoring in the timing of cash flows and offering an annualized return figure that helps assess investment efficiency.

While MOIC is more straightforward and simple, IRR is essential when comparing investments with different timeframes or when evaluating the timing of returns. Depending on the nature of the investment and the investor’s goals, both metrics can be used in tandem to offer a more comprehensive view of investment performance.

FAQs

- What is the primary difference between MOIC and IRR?

MOIC measures the total value generated by an investment relative to the capital invested, while IRR accounts for the timing of cash flows and provides an annualized rate of return. - When is MOIC more useful than IRR?

MOIC is useful when you want to assess the total value generated by an investment without considering the timing of returns. It’s often used for long-term, illiquid investments or when comparing the overall magnitude of value creation. - How does IRR take timing into account?

IRR considers the timing of cash flows by discounting future cash flows to present value, providing a rate of return that reflects how quickly or slowly an investment generates returns over time. - Can MOIC and IRR provide the same results?

While MOIC and IRR are related, they usually provide different insights. They may show the same result if the timing of cash flows is consistent, but typically they will differ, especially in investments with irregular cash flows or different timeframes. - What are the limitations of using IRR?

IRR assumes that interim cash flows are reinvested at the same rate, which may not always be realistic. Additionally, it can be misleading in cases with irregular or multiple cash flows, where it might not properly reflect the investment’s true profitability.