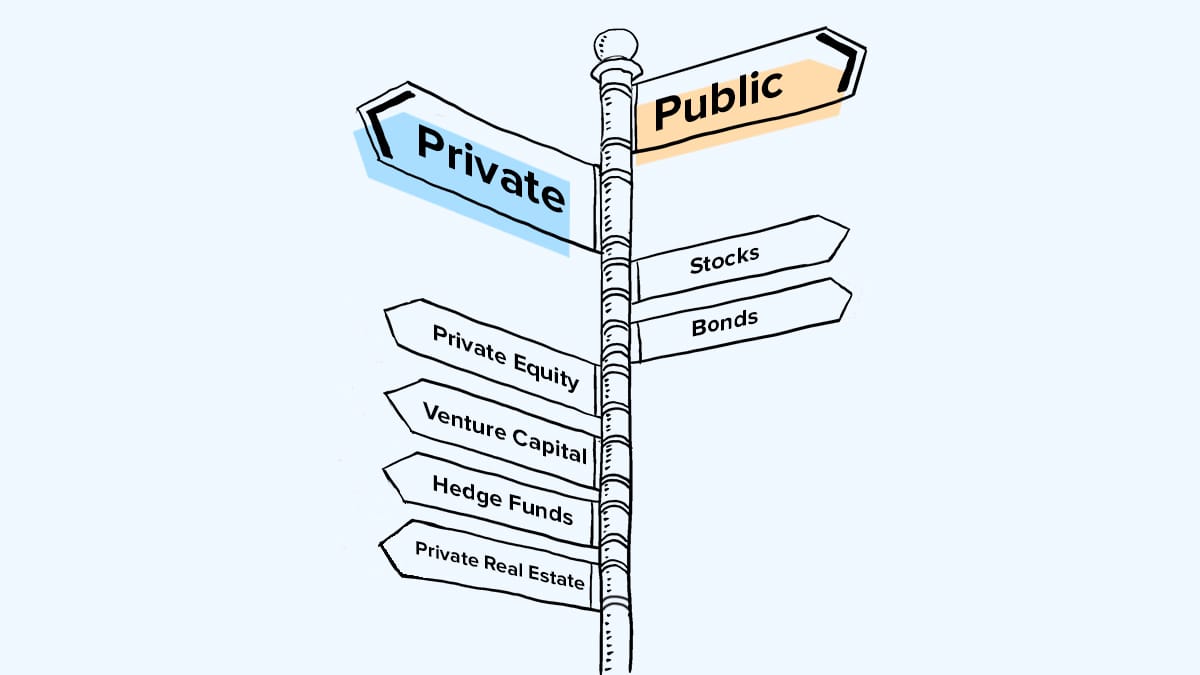

Key Differences: Public vs. Private Investing

Investing in the financial markets offers numerous opportunities, with public and private investments being two of the most prominent categories. While both offer avenues for wealth generation, they differ fundamentally in terms of accessibility, risk, return potential, liquidity, and governance. Understanding these differences is crucial for institutional investors, asset managers, and C-suite executives seeking to navigate the evolving investment landscape.

Market Accessibility

Public Markets:

Public markets are the arena where securities like stocks and bonds are bought and sold on recognized exchanges such as the New York Stock Exchange (NYSE) or NASDAQ. These markets are highly accessible to retail investors, institutional investors, and other market participants. Any investor can purchase shares in publicly traded companies through brokers, making public markets a liquid and transparent avenue for investment.

Public companies are required to comply with extensive regulatory requirements, including the filing of quarterly earnings reports, annual statements, and disclosure of material events. This transparency allows investors to make informed decisions based on readily available information.

Private Markets:

Private markets, on the other hand, involve transactions that are not listed on public exchanges. Private equity, venture capital, private debt, and direct investments in private companies all fall under the umbrella of private markets. Access to private market investments is typically restricted to accredited investors, including institutional investors, private equity firms, and high-net-worth individuals (HNWI).

Investments in private companies are often less regulated than those in public markets, resulting in less publicly available financial data. This can make due diligence more challenging for potential investors.

Liquidity

Public Markets:

One of the primary benefits of investing in public markets is liquidity. Publicly traded stocks can be bought and sold quickly at market prices, offering flexibility for investors looking to enter or exit positions with minimal friction. Investors can typically sell their shares in seconds, allowing for efficient portfolio rebalancing or cashing out.

Private Markets:

Private market investments are typically much less liquid. Investors often commit capital for long periods, with a typical holding period of 5 to 10 years before realizing a return. This is especially true for private equity and venture capital, where capital is locked in for extended periods. Exiting a private market investment may require finding a buyer in a secondary market or waiting for a liquidity event, such as an initial public offering (IPO) or acquisition.

Risk and Return Profile

Public Markets:

Public market investments, including stocks, bonds, and exchange-traded funds (ETFs), are generally more liquid but can be subject to significant volatility. Stock prices fluctuate based on factors such as market sentiment, economic indicators, and company performance. While public markets tend to offer a broader pool of diversified investment options, they are often correlated, meaning their performance may decline in tandem during market downturns.

Private Markets:

Private market investments typically come with a higher risk-return profile. Because private investments are illiquid and often involve early-stage or growth-stage companies, they tend to be riskier. For example, venture capital investments may involve backing startups that could fail, but with the potential for high returns if they succeed. The limited liquidity, combined with higher risk, often results in the potential for higher returns over the long term. McKinsey's 2022 Private Markets Report indicated that private equity investments delivered an annualized return of 13.2% from 2000 to 2021, which outperformed public equity markets, which yielded an average of around 8% over the same period.

Valuation Transparency

Public Markets:

In public markets, the price of a security is determined by supply and demand on the exchange, making valuations relatively transparent. Investors can easily observe stock prices, which reflect real-time market sentiment. Additionally, public companies are required to regularly disclose financial statements, earnings calls, and other key metrics, enabling investors to make data-driven decisions.

Private Markets:

Valuation in private markets is more subjective and less transparent. Private companies are not required to disclose the same level of financial information as public companies. This lack of regular reporting means that investors must rely on private financial data, negotiations, and due diligence reports to assess the value of a company or asset. As such, private investments may involve greater uncertainty regarding their current and future worth.

Regulation and Governance

Public Markets:

Public markets are heavily regulated by authorities like the Securities and Exchange Commission (SEC) in the United States. These regulations are designed to protect investors, ensure fair trading practices, and provide transparency. Public companies must adhere to strict reporting standards, such as quarterly earnings reports, annual audits, and disclosures of material events that could affect stock prices. This regulatory framework creates a structured environment for investors and ensures a high level of corporate governance.

Private Markets:

Private market investments are less regulated and face fewer reporting requirements compared to public markets. Private companies are not obligated to disclose financial information to the public, and only limited financial data may be available to investors. This reduces the level of corporate governance transparency for private companies, requiring investors to rely on their own due diligence processes and third-party evaluations.

Additionally, private market investors often have more influence over the governance of the companies they invest in. For example, private equity investors often play an active role in management and strategic decision-making.

Diversification Opportunities

Public Markets:

Public markets offer a wide range of diversification options, including a broad array of industries, sectors, and asset classes. Exchange-traded funds (ETFs) and mutual funds allow investors to diversify across multiple companies and regions. The transparency and liquidity of public markets make it easier to adjust portfolios and rebalance investments quickly.

Private Markets:

While private markets offer fewer options for diversification, they can provide unique opportunities to invest in niche markets or high-growth sectors that are not yet accessible in public markets. For instance, investors may access emerging technologies, infrastructure projects, or private real estate developments that are not listed on public exchanges. As these markets grow, the opportunities for diversification are expanding, but with the trade-off of less liquidity and higher risk.

Conclusion

Both public and private markets offer valuable investment opportunities, but they come with distinct advantages and challenges. Public markets provide liquidity, transparency, and regulatory oversight, making them suitable for investors seeking a more straightforward, diversified, and liquid investment approach. Private markets, in contrast, present higher-risk, high-reward opportunities, with a focus on illiquid investments that may offer superior returns over time, but with greater uncertainty and less regulatory oversight.

FAQs

- What are the key differences between public and private markets?

Public markets are accessible to all investors, provide liquidity, and are subject to rigorous regulations. Private markets are less liquid, typically require accredited investors, and offer opportunities for higher returns with more risk. - How do private market investments compare to public investments in terms of risk and return?

Private market investments generally involve higher risk due to their illiquid nature and exposure to early-stage or growth-stage companies, but they offer higher return potential, especially in sectors like venture capital and private equity. - Why are private markets less regulated than public markets?

Private markets are not subject to the same public reporting and regulatory requirements, providing companies more flexibility in their operations. This also means that investors must conduct more thorough due diligence. - Can I invest in private markets as a retail investor?

Typically, private market investments are accessible only to accredited investors, which include institutional investors and high-net-worth individuals (HNWI). However, with the rise of investment platforms, some private market opportunities are becoming more accessible to retail investors. - How can I diversify my portfolio with private market investments?

Private market investments can provide exposure to niche industries or emerging sectors not available in public markets. While private markets are less liquid and offer fewer diversification opportunities, they can still be an effective means of diversification when combined with public market investments.