IRR Calculation: A Step-by-Step Tutorial

The Internal Rate of Return (IRR) is a critical financial metric used to evaluate the profitability of an investment over time. It is widely used in private equity, venture capital, real estate, and other investment sectors to assess the performance of an asset or project. By calculating the IRR, investors can determine the rate at which the present value of future cash flows equals the initial investment, helping them decide whether an investment is worth pursuing.

In this step-by-step tutorial, we will walk you through the process of calculating IRR, including the methodology, the formula, and an example calculation. By the end, you'll have a clear understanding of how to apply IRR in real-world investment scenarios.

What is IRR?

IRR is the discount rate that makes the Net Present Value (NPV) of an investment's cash flows equal to zero. In simpler terms, it’s the rate at which an investor expects to earn a return on their investment over its holding period. The higher the IRR, the more attractive the investment is, as it indicates that the investment is expected to generate more returns relative to the cost of capital.

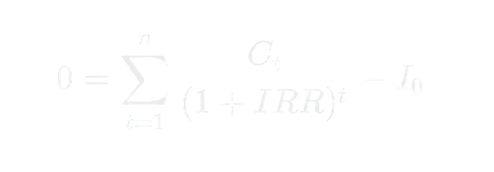

The formula for IRR can be expressed as:

Where:

- Ct = Cash inflows at time t

- I0 = Initial investment (cash outflow at time 0)

- IRR = Internal Rate of Return (the discount rate we need to find)

- t = Time period

- n = Total number of periods

Since solving for IRR analytically can be complex, it’s often found using financial calculators or spreadsheet software like Excel or Google Sheets.

Step-by-Step Process to Calculate IRR

Step 1: Gather the Cash Flow Data

The first step in calculating IRR is to gather the projected cash flows for the investment. These cash flows include:

- Initial Investment: This is typically a negative cash flow because it represents the outflow of capital at the beginning of the investment.

- Future Cash Flows: These are the expected returns from the investment in future periods (often projected annually). These cash flows can vary depending on the nature of the investment.

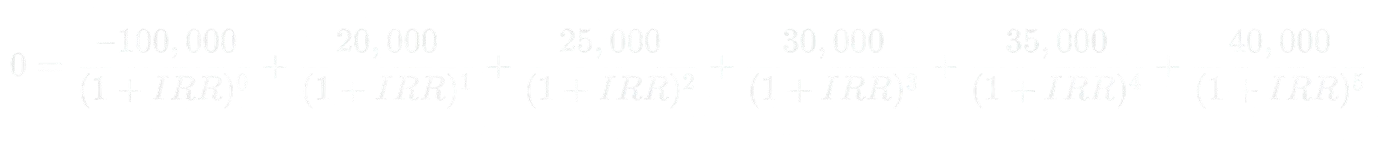

For example, suppose you invest $100,000 in a business, and you expect to receive the following cash flows over the next five years:

- Year 0: -$100,000 (initial investment)

- Year 1: $20,000

- Year 2: $25,000

- Year 3: $30,000

- Year 4: $35,000

- Year 5: $40,000

Step 2: Choose a Method to Calculate IRR

There are several ways to calculate IRR, with the two most common being:

- Trial and Error Method: You can manually try different discount rates (starting with a guess) to find the rate that makes the NPV of cash flows equal to zero. This process involves adjusting the rate until you achieve a result close to zero.

- Using Financial Software (Excel/Google Sheets): This is the most practical and accurate method. Both Excel and Google Sheets have built-in functions to calculate IRR easily.

To use Excel or Google Sheets, you would input your cash flows in cells, and then use the IRR function.

For example:

=IRR(A1:A6)

Where A1:A6 contains the cash flows (from Year 0 to Year 5).

Step 3: Plug the Cash Flows into the Formula

If you decide to calculate IRR manually (which is usually only done for small datasets), you would input your cash flows into the IRR formula:

You would then use trial and error to find the rate (IRR) that makes the equation equal to zero.

However, this process is time-consuming, and using financial software is far more efficient.

Step 4: Interpret the Result

Once the IRR is calculated, it’s time to interpret the result:

- Higher IRR: A higher IRR generally indicates a more attractive investment, as it implies a higher rate of return on invested capital. If the IRR is greater than the company’s required rate of return (also known as the hurdle rate), the investment is considered favorable.

- Comparison with Hurdle Rate: In practice, IRR is compared to a company’s required rate of return, or the cost of capital, to decide whether the investment should proceed. If the IRR is greater than the required rate of return, the investment is generally considered worthwhile.

- Decision Making: For example, if the IRR is 15% and the required rate of return is 10%, the investment may be considered acceptable since it exceeds the required return. However, if the IRR is only 5%, the investment may be rejected.

Example Calculation Using Excel

Let’s say you want to calculate the IRR for the investment example we discussed above. Here’s how you would do it using Excel or Google Sheets:

- Enter the Cash Flows:sqlCopy code

Year 0: -100000

Year 1: 20000

Year 2: 25000

Year 3: 30000

Year 4: 35000

Year 5: 40000 - Use the IRR Function: In Excel or Google Sheets, use the function

=IRR(A1:A6)

WhereA1:A6contains the cash flow data (from Year 0 to Year 5). - Result: The IRR function will return a value, say 16.67%, meaning that the internal rate of return for this investment is 16.67%.

Limitations of IRR

While IRR is a useful and widely-used metric, it has several limitations that investors should be aware of:

1. Multiple IRRs

In some cases, especially with projects that have alternating positive and negative cash flows (e.g., multiple large outflows followed by inflows), IRR calculations can yield multiple values. This makes interpretation difficult and may require further analysis, such as using modified internal rate of return (MIRR), which resolves this issue.

2. Assumption of Reinvestment Rate

IRR assumes that interim cash flows are reinvested at the same rate as the calculated IRR, which may not always be realistic. In many cases, MIRR is preferred as it assumes that cash flows are reinvested at a rate that more accurately reflects the cost of capital or an appropriate reinvestment rate.

3. Sensitivity to Cash Flow Timing

IRR is highly sensitive to the timing of cash flows. Small changes in the timing of when cash flows occur can significantly affect the IRR. This can make it difficult to compare projects with very different cash flow patterns or timelines.

4. Overstating the Attractiveness of Long-Term Projects

For projects with long durations, IRR can sometimes overstate the attractiveness of an investment, especially if the cash flows are heavily weighted in the later years. In these cases, net present value (NPV) may provide a better gauge of an investment’s true value.

Conclusion

IRR is a powerful tool for evaluating investment opportunities, but it should be used with an understanding of its limitations. It offers a quick way to assess the profitability of an investment, but investors should be cautious of relying on it exclusively. Combining IRR with other metrics such as NPV, payback period, and MIRR can provide a more comprehensive view of an investment’s potential.

By following the steps outlined in this tutorial and using tools like Excel or Google Sheets, you can effectively calculate IRR and use it to make more informed investment decisions.

FAQs

1. How does IRR differ from NPV?

While IRR represents the rate at which the net present value (NPV) of cash flows equals zero, NPV provides the total value created by an investment, given a specific discount rate. IRR assumes reinvestment at the same rate, whereas NPV uses a fixed discount rate.

2. What is the best way to calculate IRR?

The best way to calculate IRR is by using Excel or Google Sheets. These tools have built-in functions that make calculating IRR quick and accurate.

3. What is the significance of a higher IRR?

A higher IRR suggests a more profitable investment opportunity. It indicates that the investment is expected to generate higher returns relative to its cost of capital.

4. Can IRR be negative?

Yes, if the sum of the cash flows results in a loss, IRR can be negative, which would indicate that the investment is not expected to generate sufficient returns to cover the initial investment.

5. When should I use IRR?

IRR is useful for comparing investment opportunities, especially when considering different projects with similar timelines. However, it is best used alongside other financial metrics, such as NPV, to get a more comprehensive evaluation of the investment.