Distribution Waterfall Model in Private Equity

The distribution waterfall model is a critical aspect of private equity (PE) funds, detailing how profits from investments are distributed between the general partners (GPs) and limited partners (LPs). This model ensures that both parties are compensated fairly based on their investment contributions, with special provisions to incentivize the fund managers. Understanding how the distribution waterfall works is essential for institutional investors, family offices, and anyone looking to gain a deeper insight into the financial mechanics of private equity funds.

In this blog, we’ll explain the distribution waterfall model, breaking down its stages, components, and how it affects the financial interests of both GPs and LPs.

1. What is a Distribution Waterfall in private markets?

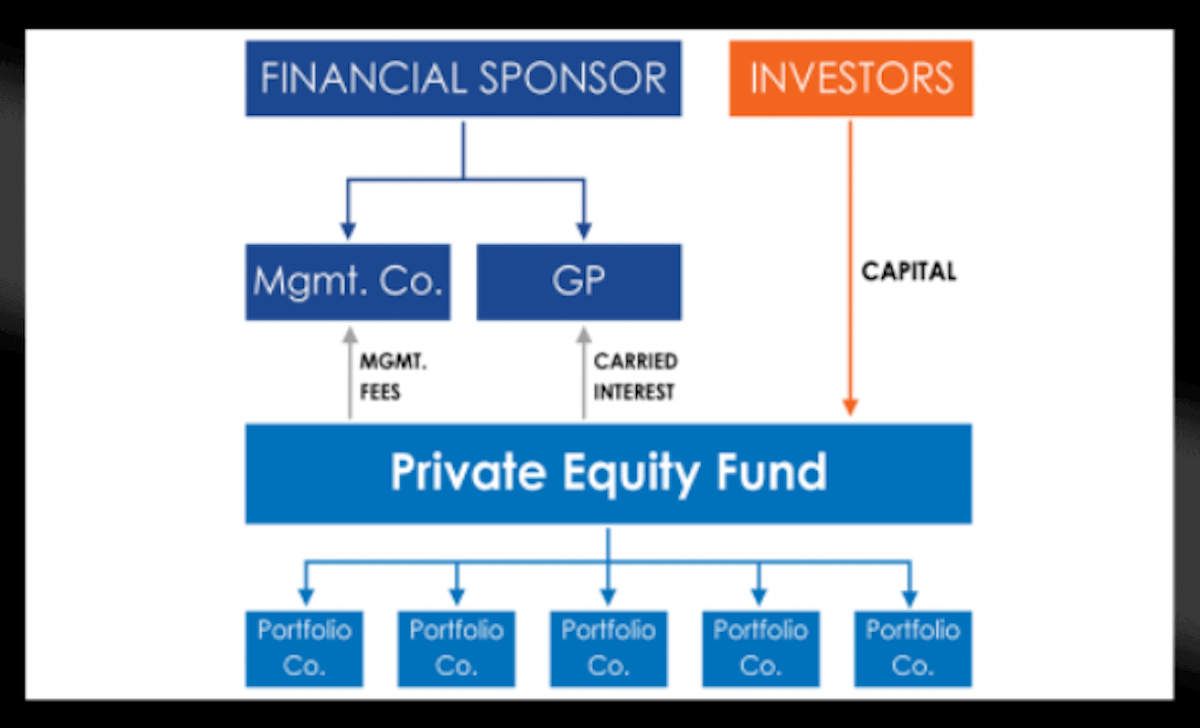

A distribution waterfall is a structured mechanism that outlines the sequence in which profits from a private equity fund are distributed. The waterfall ensures that profits are allocated according to the agreed-upon terms and reward the general partners for successfully managing the fund and generating returns.

The typical distribution waterfall model consists of several tiers or stages that define how profits are shared between the LPs (who provide most of the capital) and the GPs (who manage the fund).

2. Key Stages of the Distribution Waterfall

2.1. Return of Capital to Limited Partners (LPs)

The first stage in the distribution waterfall ensures that the limited partners receive their invested capital back. This means that the LPs will first get their original investment amount back before any profits are distributed.

- Example: If an LP invests $10 million in the fund, this stage ensures that they receive their $10 million back before any profits are split between the LPs and the GPs.

2.2. Preferred Return (Hurdle Rate)

After the LPs receive their capital back, they are entitled to a preferred return (or hurdle rate). This is a minimum annual rate of return that must be achieved before the GPs are entitled to any performance-based fees (carried interest).

- Typical Rate: The preferred return typically ranges from 6% to 10% per year, depending on the agreement.

- Example: If the preferred return is set at 8%, the LPs must receive an 8% return on their invested capital before any profits are split between the LPs and GPs.

2.3. Catch-Up Provision

Once the preferred return is paid to the LPs, the next stage is often the catch-up provision. During this stage, the general partner (GP) is entitled to a larger portion of the profits until they "catch up" to the agreed-upon share of the profits, often based on the carried interest structure.

- Example: If the GP is entitled to 20% of the profits as carried interest, the catch-up provision ensures that once the LPs have received their preferred return, the GP will receive a higher percentage of profits (typically 100%) until they are "caught up" with the amount they should receive in carried interest.

2.4. Profit Split (Carried Interest)

Once the capital is returned to the LPs, the preferred return is paid, and the catch-up provision is satisfied, the remaining profits are distributed. This stage splits the profits between the LPs and GPs according to an agreed percentage, with the GP typically receiving a carried interest portion of the profits.

- Example: In the most common arrangement, the GP receives 20% of the profits (carried interest), while the LPs receive 80%. This is designed to incentivize the GP to maximize returns, as their compensation is tied directly to the fund's performance.

3. Example of a Distribution Waterfall Model

Let’s consider a hypothetical private equity fund with the following terms:

- Total Capital Invested by LPs: $10 million

- Preferred Return: 8%

- Carried Interest for GP: 20%

Step 1: Return of Capital

The first step is the return of the capital invested by the LPs. If the fund has made $12 million in profits, the LPs will receive their initial $10 million investment back.

Step 2: Preferred Return (Hurdle Rate)

Next, the LPs are entitled to their preferred return of 8% on the invested capital. So, the LPs will receive 8% of $10 million ($800,000) as their preferred return.

Step 3: Catch-Up Provision

Once the LPs have received their preferred return, the GP will enter the catch-up provision. For example, the GP might receive 100% of the next profits until they’ve received 20% of the total profits. This ensures that the GP is rewarded with a higher share of profits once the LPs are made whole.

Step 4: Profit Split (Carried Interest)

Once the catch-up provision is satisfied, the remaining profits are split according to the agreed-upon ratio—often 80% for LPs and 20% for the GP. This is where the GP earns their carried interest, a performance-based fee that incentivizes them to maximize returns.

Total Distribution Example:

- Total Profits: $12 million

- Return of Capital: $10 million to LPs

- Preferred Return: $800,000 to LPs

- Catch-Up: GP receives $200,000 (to align with the 20% carry structure)

- Remaining Profits: $1 million

- LPs: $800,000 (80% of $1 million)

- GP: $200,000 (20% of $1 million)

4. Types of Distribution Waterfall Models

There are several variations of the distribution waterfall model, depending on the terms of the agreement between the LPs and GPs. Some common types include:

4.1. Standard Waterfall

The standard waterfall is the most commonly used model, where the distribution follows the typical order: return of capital, preferred return, catch-up provision, and profit split (carried interest).

4.2. European Waterfall

In a European-style waterfall, the entire fund must return capital and achieve the preferred return before any carried interest is paid to the GP. This is more conservative and ensures that LPs receive their full capital and preferred return before the GP earns any performance fees.

4.3. American Waterfall

The American-style waterfall allows the GP to start earning carried interest after each individual investment is realized, even before the full fund has returned capital and preferred returns. This model is more favorable to the GP and allows them to receive compensation earlier.

5. Importance of the Distribution Waterfall

The distribution waterfall is crucial for aligning the interests of GPs and LPs. It ensures that the GP is incentivized to maximize returns for investors, as their compensation is tied to performance. For LPs, the waterfall provides transparency and clarity on how profits will be allocated and how their capital will be returned.

- Investor Protection: The preferred return and catch-up provisions help ensure that the LPs are compensated before the GP receives their carried interest.

- Alignment of Interests: By linking the GP’s compensation to the performance of the fund, the waterfall aligns the interests of both parties, ensuring the GP is motivated to maximize value for the fund.

- Transparency: The distribution waterfall clarifies how profits will be split at each stage of the fund’s lifecycle, providing transparency for all stakeholders.

6. Conclusion

The distribution waterfall model is a key feature of private equity funds, determining how profits are distributed between limited partners (LPs) and general partners (GPs). It ensures that LPs are compensated first with their capital and preferred return, while the GP is incentivized through carried interest based on the fund’s performance. Understanding how the waterfall works is essential for both investors and fund managers, as it defines the financial structure and alignment of interests within the fund.

FAQs

1. What is the preferred return in a distribution waterfall model?

The preferred return is a minimum rate of return that must be achieved before the general partner can begin receiving carried interest. It ensures that limited partners are compensated for their investment before the GP earns performance-based fees.

2. How does the catch-up provision work?

The catch-up provision allows the general partner to receive a larger portion of profits (often 100%) until they have earned their agreed-upon share of the fund’s total profits, typically 20% in carried interest.

3. What is the difference between a European and American waterfall?

In a European waterfall, the entire fund must return capital and achieve the preferred return before any carried interest is paid to the GP. In an American waterfall, the GP can begin receiving carried interest as soon as individual investments are realized, even before the full fund reaches the preferred return.

4. Why is the distribution waterfall important for investors?

The distribution waterfall ensures that the interests of the general partner are aligned with those of the limited partners. It provides transparency on how profits will be split and protects LPs by ensuring they receive their capital and preferred return before the GP is paid.

5. Can the distribution waterfall model vary?

Yes, the distribution waterfall model can vary based on the specific terms of the private equity fund. Different models include the standard waterfall, European waterfall, and American waterfall, each with distinct characteristics and implications for how profits are distributed.